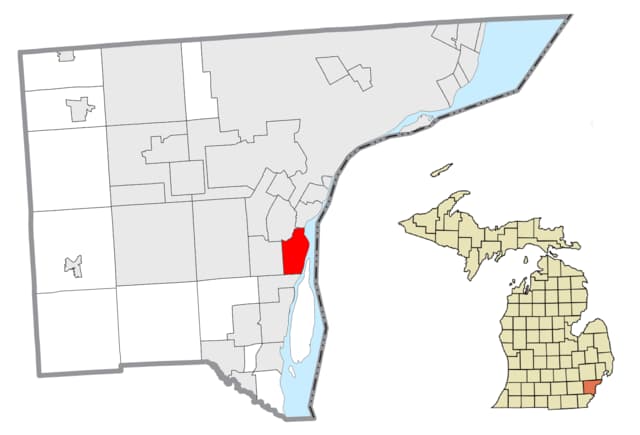

Wyandotte Chapter 7 Bankruptcy Attorney

If you live in Wyandotte, MI and are struggling with debt, you have probably considered filing for Chapter 7 bankruptcy. If so, you’re probably wondering how to go about it. Filing for personal bankruptcy isn’t as straightforward as many people think, and it can be difficult to qualify. While there are other debt relief options, liquidation bankruptcy is a way to get a clean financial slate.

When it comes to filing for Chapter 7 bankruptcy in Wyandotte, you’ll want to hire a local Chapter 7 bankruptcy lawyer that knows the best way to qualify in Michigan. A local bankruptcy lawyer can help you with navigating the complex legalese of the bankruptcy court to get you the best outcome possible.

How Do I File For Chapter 7 Bankruptcy?

Filing for Chapter 7 bankruptcy can be challenging for non-attorneys. While it can be done, there are crucial steps in the process where a dedicated Wyandotte bankruptcy lawyer can help you to make sure your case goes smoothly.

Step 1: Determine Eligibility

- Means Test: Ensure you pass the means test, which compares your income to the median income in Michigan. If your income is below the median, you qualify automatically. If not, further calculations are required to determine eligibility.

- Credit Counseling: Complete a credit counseling course from an approved provider within 180 days before filing.

Step 2: Gather Necessary Documents

- Financial Records: Collect all financial documents, including income statements, bank statements, tax returns, and information on all your debts and assets.

- Expenses: Document your monthly living expenses to provide a clear picture of your financial situation.

It is very important to be thorough and honest in this step, as you could be charged with bankruptcy fraud, a very serious crime. If you decide to not hire a Wyandotte bankruptcy lawyer, you could unwittingly commit bankruptcy fraud.

Step 3: Complete Bankruptcy Forms

Official Forms: Fill out the official bankruptcy forms, which can be found on the U.S. Courts website or provided by your local bankruptcy attorney. These include:

- Voluntary Petition (Form 101)

- Schedule of Assets and Liabilities (Forms 106A/B through 106J)

- Statement of Financial Affairs (Form 107)

- Means Test Calculation (Form 122A-2)

- Other necessary forms depending on your situation

Step 4: File the Petition

- Bankruptcy Court: File your completed forms with the bankruptcy court in your jurisdiction. You can file electronically or in person.

- Filing Fee: Pay the filing fee which is currently around $335, or request a fee waiver or payment plan if you can’t afford it. Your Wyandotte bankruptcy lawyer can help you with this fee waiver.

Step 5: Automatic Stay

The automatic stay provides protection from creditors. Upon filing, an automatic stay goes into effect, halting most collection activities, foreclosures, and lawsuits against you.

Step 6: Appointing a Trustee

The court appoints a bankruptcy trustee to oversee your case, review your documents, and manage the liquidation of your non-exempt assets.

Step 7: Meeting of Creditors (341 Meeting)

You must attend a meeting of creditors, usually held about a month after filing. The trustee and creditors may ask you questions about your financial situation and the information in your filing.

Step 8: Financial Management Course

Complete a debtor education course from an approved provider after filing but before discharge. This is a required course and you will need to provide proof of completion to the trustee.

Step 9: Trustee’s Actions

The trustee may sell your non-exempt assets to pay creditors. Exempt assets (like certain personal property and necessities) are protected. Your Wyandotte Chapter 7 bankruptcy lawyer will help you with exempting certain property from being sold off.

Step 10: Discharge

If there are no objections from creditors or the trustee, and you have completed all requirements, the court will issue a discharge order, typically within 3-6 months, wiping out most of your unsecured debts.

Should I File Chapter 7 Bankruptcy or Get a Debt Consolidation Loan?

Your circumstances will dictate whether Chapter 7 bankruptcy is the right decision for you. A Wyandotte bankruptcy lawyer can help you determine what the best solution is. One option you have other than filing for personal bankruptcy would be a debt consolidation loan.

What is a Debt Consolidation Loan?

A debt consolidation loan is a type of loan that allows you to combine multiple debts into a single loan with one monthly payment. This can simplify your finances and potentially reduce your interest rates or monthly payments. Some of the benefits to a debt consolidation loan include:

- You make one single payment as opposed to several payments to different creditors.

- You may be able to lower your interest rate by consolidating your debt.

- You can get a fixed term, which means you aren’t paying the loan on a revolving basis like a credit card.

If you have the ability to qualify for a loan and you can make the payments on time, then a debt consolidation loan may make sense for you. If you own a home, a HELOC can be one way to obtain a debt consolidation loan, however, a HELOC uses your home as collateral, so you may want to look for an alternative if you fear you might not be able to pay your loan off.

Debt Consolidation vs. Bankruptcy

A debt consolidation loan could be a lot like kicking the can down the road, especially if you are unemployed, low-income or retired. Chapter 7 bankruptcy might be a better option, as you will get the following benefits:

- Discharge of the vast majority of your debt

- The ability to rebuild your credit score

- A fresh start on your financial health

Of course, bankruptcy will impact your credit score negatively, and will remain on your credit report for 10 years. However, your score can improve if you make the right decisions. Your Wyandotte bankruptcy attorney can help you with understanding the best way to proceed following your bankruptcy discharge.