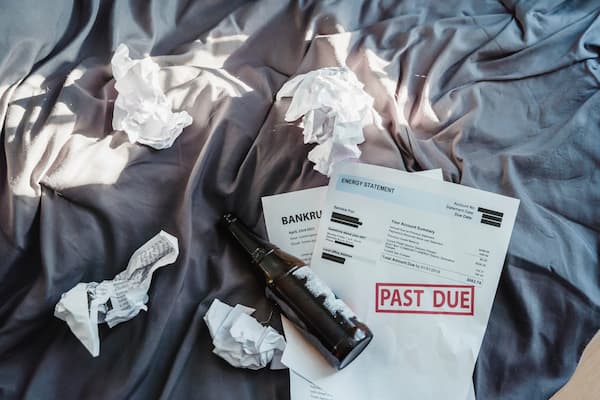

Why File Chapter 7 Instead of Chapter 13 Bankruptcy?

Choosing the right bankruptcy for your situation is critical. Here are some reasons why a Chapter 7 might be right for you.

Many clients walk into our offices confused about the bankruptcy process. This is completely understandable, because the laws aren’t written in plain English. It is important to go through your bankruptcy with the help of an attorney. Knowing what chapter bankruptcy to file is not a simple choice, and we’ll explore the differences between the common types of personal bankruptcies.

Income Qualification

Did you know that you need to meet a certain income threshold to qualify for a Chapter 7 bankruptcy? This is one important note that many miss. To qualify, your current monthly income (average monthly income for six months prior to the bankruptcy case) must be less than the median income for your household size in your state. In Michigan, this would be $66,198 for a two-person household.

If your monthly income is too high, you must pass a means test to qualify. If a Chapter 7 filer has too much disposable income under the means test, the court may reject the petition or switch it to a Chapter 13 filing.

Other Advantages to Chapter 7 Bankruptcy

Chapter 7 offers the fastest path through bankruptcy. A Chapter 7 filing may take as little as four months from filing to final resolution. This is largely because there’s no repayment plan involved, as is the case with Chapter 13 bankruptcy, which can involve three to five years of regular payments before debts are paid off.

In Chapter 7, filers may get to keep some personal property that’s exempt from liquidation. Exemptions vary by state and aim to let debtors keep working and living. Exceptions may include automobiles, clothing, furniture, pensions and some home equity. In practice, most Chapter 7 filings are so-called no-asset cases where all the debtor’s assets are exempt.

Reaffirmation is a useful Chapter 7 tool that gives a debtor some flexibility. If a debtor wishes to keep specific secured debt, they can reaffirm the debt, or make an agreement with the creditor to pay all or a portion of the amount owed. This tool can let the debtor keep, for instance, a home or car that may otherwise have to be sold.

The Downsides of Chapter 7 Bankruptcy

The major downside of Chapter 7 is that you’ll have to sell certain property that bankruptcy won’t let you keep (non-exempt assets). Another limitation of Chapter 7 is that co-signers may still end up on the hook for their portion of the debt—creditors are still free to pursue your co-signer, even if they can no longer pursue you. Plus, you can only file Chapter 7 once every eight years.

Again, the other downside is the income qualification. Not everyone qualifies to file Chapter 7, and it is much easier to qualify for a Chapter 13 bankruptcy. However, a means test can help get you qualified.

If you’re thinking of filing bankruptcy, contact The Mitten Law Firm today.

Recent Posts

- How Much Does It Cost To File Chapter 7 Bankruptcy?

- Claiming A Child On Your Taxes With Joint Custody

- Prenuptial and Postnuptial Agreements In Michigan Divorces

- Filing Chapter 7 Bankruptcy When You Own Multiple Homes

- Can I Change My Child’s School?

- How Is Debt Handled In A Michigan Divorce?

- How To Choose a Bankruptcy Attorney

- What NOT To Say During Child Custody Mediation

- Does It Matter If My Spouse Cheated In a ‘No-Fault’ Divorce State?

- How Long Does Chapter 7 Bankruptcy Stay On Your Credit Report?